How 18 year old me could have wised up

The best thing about the future is it comes one day at a time - Abraham Lincoln

When looking for inspirational and cringy quotes about time, I started thinking about just how profound the concept of time is and how individual it is for every one of us.

Some find the passing of time terrifying, others couldn't care less (at least outwardly).

Some are fantastic organisers and custodians of their time, others take each day as it comes and resist excessive planning.

Some find the concept of the future exciting and count the days, others peer sadly over their shoulder at times gone by.

Personally, I find myself somewhere in the middle. Excessive planning freaks me out but letting too many hours or days go by without thinking intentionally about my time makes me feel restless and anxious. I think this is probably the same for a lot of us.

At the end of the day there are things we all have in common in regards to our time, one of them being, to massively paraphrase Lincoln, that we only really have control over each individual day ahead of us.

How is this relevant in any way to finance?

I'm so glad you asked! When I started becoming interested in personal finance and disinterested in being broke, there was something I just couldn't get out of my head that still plagues me occasionally today:

If only I'd started all this shit when I was younger!

While I hope the thoughts in this blog will be useful to anyone regardless of age, there is a simple fact about time and money that one can't ignore:

The more time you have (AKA the earlier you start), the greater chance you give yourself to make lots and lots of cash.

We have numerous examples of things working out exactly like this - Warren Buffet, with a current net worth of $142 billion, bought his first stock at 11 years old.

I'm not going into saving and investing in this post, but I did want to play around with some interesting maths to highlight exactly what I mean, because from recent conversations with friends this really is something people don't know (because we aren't taught) and struggle to understand (because we're supposed to be young, poor and struggling, right?).

In my first post I mentioned the relationship between a younger (and much heavier) me and the local chicken shop. I was in there smashing down the fried chicken burger meal deal AT LEAST 4 times a week, often more.

In addition to the probably irreversible damage to my insides, this habit also set me back about £5 a pop, averaging out at roughly £20 a week (which would have been more than enough to comfortably provide a week of filling, nutritious meals, but more on that another time). That £20 a week becomes roughly £88 a month, which becomes £1056 a year, which becomes £3168 over the three years of my degree. It's only as I'm writing this that I realise this almost covers the entirety of what I ended up leaving with as an overdraft - terrifying and hilarious!

I want to go into the power of compounding another day, but to finally get round to my point and as a brief, introductory illustration:

If 18 year old me had taken that £20 a week and popped it in a savings account, I would have left university with about £3k saved, because interest rates during this period were non-existent (less than 1%). If I'd have carried on saving my £20 a week, because of establishing that great habit early on, until now, I'd have roughly £10500 sitting in my 'Instead of buying fried chicken' pot. Not bad!

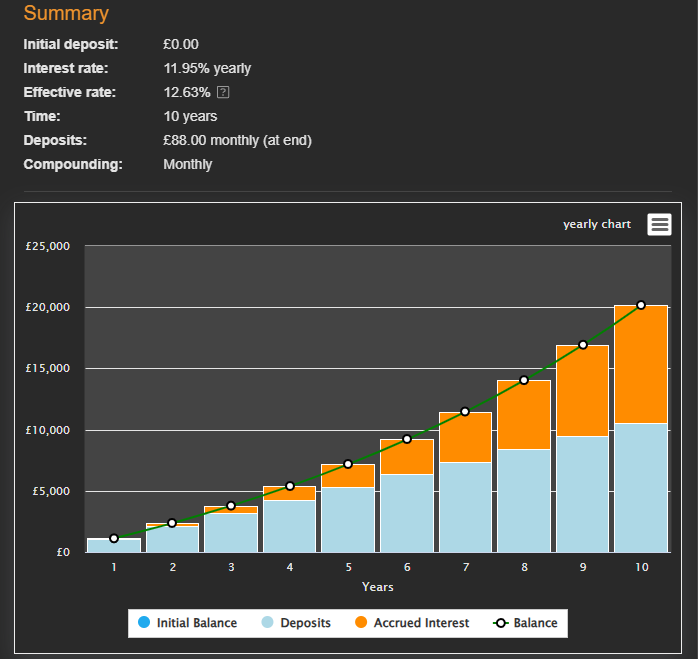

Sadly, however, 18 year old me could have done even better. If that £20 a week had been invested instead, and I'd continued that habit up til now, my 'Instead of buying fried chicken' pot would currently be sitting at roughly £20,100, with almost half of that being interest. That is a growth rate of about 224%, or 12% per year on average across the last 10 years. That's some seriously expensive chicken.

The bad news?

I didn't do any of that. You probably didn't either. In fact, one can make an extremely strong case for enjoying your chicken burgers, beers, nights out with friends and holidays while you're young and actually have the vitality to enjoy them, and worry about being financially secure later on.

The clock, however, is metaphorically and literally ticking. But somewhere in all of this, there can be balance - and we're going to figure out how to find that balance together, so we can spend money on the things that matter to us, ignoring the things that don't, whilst still building up our 'Instead of buying fried chicken' pots to secure our future freedom, and most importantly, our time.

Make sure to sign up to be notified next time I post - and until next time!