Getting started: a Survivalists Guide to an Expensive World

It's all well and good spouting about chicken burgers and financial freedom...

I hear you mutter under your breath...

But how do I actually start taking control of my money? Bills are up, my kids need new shoes every four minutes and have you seen the price of a Nando's half chicken these days?

You exclaim, slightly louder this time, becoming actually visibly irritated.

HELP ME!

Relax. I've got you! But first, I need to be brutally honest with you (and myself).

There is absolutely nothing particularly complicated about building wealth and securing financial freedom, whether you're young, old, or somewhere in between.

Complexity is sadly the hook that a lot of financial influencers will use to sell you something that promises to 'outperform' the market, or to get you to buy a course that promises to teach you the 'next big thing you need to understand to build a billion dollar portfolio'. I'm not saying there is no value in any of this information: if I was, I definitely wouldn't be writing this in the hopes that someone, somewhere reads it and gets something useful out of it. But the truth is, it really is much less complicated than a lot of these people make it out to be.

You know what else isn't complicated?

Bear with me. These are the steps I need to take in order to win the EuroMillions:

- Unlock my phone (no need to really do anything here, as it does it for me as soon as I look at it)

- Open an app with one touch

- Find the game I want a ticket for and click 'buy' (my payment details already being saved, ready to go)

- Done

I would be hard pressed to find many people who have the capacity to manage their own finances that would describe that process as 'complicated'.

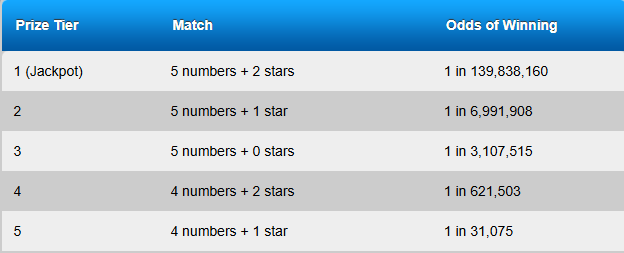

There is of course the tiny caveat that my current odds of purchasing a jackpot winning ticket for the EuroMillions are 1 in 139,838,160. Or roughly 0.000000715%.

Hopefully that example highlights the difference between complicated, and difficult. The entire reason I'm writing this, and the reason I got started reading, listening and learning about personal finance in the first place is because although the basic premises and foundations are simple, the execution of it all can be really, really bloody hard. Especially when according to the ONS, 86% of adults identify the cost of living as one of the most important issues facing the UK today.

I meant it when I said I need help, can we maybe possibly just get to some actual practical information?

Patience, dear reader... We just needed to set the stage. What I would really love to do is empower you to take control, by understanding that you don't need to be either a genius or the child of a billionaire to get yourself feeling even just a bit more comfortable financially. Although, totally fine if you are either of those things. If the latter, you can buy me a coffee.

What we actually need to do to start surviving and thriving financially

I believe there are three main elements to a truly badass financial plan. I'm going to outline them today and go into more detail (A LOT more detail) in other posts.

Take stock (HEAD TO BUDGETOPIA BABY)

Budgeting. This is where a lot of us fall down before we've even had a chance to be successful, and you may have even rolled your eyes when you read this (even though you knew it was coming!).

I'm not saying you need a perfect, beautiful colour coded excel (or Sheets if you're a hipster) spreadsheet. In my opinion, you don't even need to account for every penny you spend.

Something, in almost every case, is better than nothing.

A full guide to budgeting will be coming your way soon, but to get started, ask yourself the question:

Is what's going out, more than what's coming in? Where am I spending the majority of my money? Am I addicted to questionably cooked fried chicken burgers?

There is so much you can do here, and until you know where your money is going, it's really difficult to take control.

Every £ is a soldier in your own personal Budgetopian army, and if you don't give them orders, they'll only wage war against you.

Spend Less / Earn More

When I was about twenty, living in London during my undergraduate degree and surviving on leftover raw tofu from my part-time job at a Vegan pub, I posted on the UK Personal Finance Reddit page with a plea for help. I was sick of being broke, hungry and saying no to weekend trips to see my partner. The first response I got made me red with rage.

You have to spend less than you earn. If you're outgoings are more than your incomings, your outgoings will be your undoing's.

Thanks, Captain Obvious, I replied sarcastically. I thought I might get some genuine help, not just a condescending, patronising and ultimately useless response.

But guess what?

They were right.

It doesn't matter how much you earn, or how much you spend. The formular doesn't care how much your rent is, how much food costs these days, or how you can't even leave your flat and breathe the air without spending a tenner in London. It doesn't care if you're an analyst at a private equity firm or flip burgers at the local Spoons.

If, in whatever capacity and whatever context, you spend less than you earn, you are travelling in the direction of financial freedom. And in terms of earning more... we'll get there! (I bloody hope so anyway...)

Save and Invest

In his book The Richest Man in Babylon, George S. Clason provides readers with some timeless wisdom surrounding personal finance and growing wealth. The book resonated with me for a few reasons: mostly, because I'm a nerd and like books other people find quite dull. But secondly because it really hammers home the importance of saving and investing for your future self.

Perhaps I should have put this step as #2, given the importance of paying yourself first. Too many of us get a job to seemingly only to wait for payday and then immediately pay everybody else's bills. This could be in the form of credit card payments, car payments, monumental and unnecessary phone bills or simply the habit of splashing out on a basket full of clothes you don't really need and haven't really thought about the morning of payday.

If you don't set aside a portion of your money every time you get paid for your future self, you are never growing your wealth, or even really being paid for the work you've painstakingly put in over the past month - you're only making other people richer.

This realisation was the catalyst for a major mindset shift for me, which when combined with a half-decent budget and the spend less/earn more mentality, catapulted me into a period of life where I feel I am able to take control of my money and move forward to an exciting, financially free future - whilst paying far too high rent and barely working thanks to a busy postgraduate schedule.

Hopefully this has given you a few things to think about while you get ready to boogie on over to Budgetopia with me. Next time, as promised, we're going to go deeper on what a budget is, how to create (and most importantly stick to) one, and how you can use it to achieve awesomeness and start winning. Let's do it!

Cheers!

Budgetopian x