Financial Goals and How To Set Them

Goal setting is a hot topic, and for good reason. Spend any amount of time online and there's a seemingly endless supply of goal-setting superfans, from billionaire entrepreneurs setting business goals to stoic, battle-scarred healthcare workers setting rehabilitation goals, to athletes setting goals for their season to help shape their training plans. It seems to me that we all know how important setting goals is, and it's no different with our money.

For the aforementioned athlete to lace their shoes up every morning and get after it, following to the letter their pristine, fridge mounted day by day training plan (these are potentially mostly no longer fridge mounted), they have to know what they are doing it for, and where they are trying to end up.

As part of my Occupational Therapy postgraduate degree we are taught that in order to construct a useful treatment plan, and really in order to interact appropriately with an individual in any way, we have to know what we are doing it for, and where the individual is trying to end up (what matters to THEM).

Even the billionaire entrepreneur, sipping martini after martini whilst simultaneously filming motivational YouTube shorts aboard his interdimensional space yacht, probably still needs to know where they are trying to get to.

But... Why?

Really good question, and I think the answer to why we need goals is multifaceted. Let's use the example of our athlete.

- MOTIVATION

If the athlete doesn't have a goal, how much more difficult does that make the early morning tempo workouts in the rain? Quite literally, what are they doing it for? If one knows that the results of their hard work will get them to a place they have intentionally set out reach (something they genuinely want to achieve), the magic powers of motivation and discipline will help you get there. If you don't have a goal, then what's the point?

- SPECIFICITY

Benson's Law of Specificity is fairly simple: in order to get better at something, you have to actually do that thing. While this sounds really simple, and maybe the application is more obvious in our athlete example than perhaps with our money (it's coming, I promise), it's amazing how many people neglect to acknowledge the fact that if you want to get better at something, you really do have to pull your socks up and do the thing.

How on earth could a coach structure a training plan, targeting specific, carefully thought out and well-researched physiological adaptations, without first identifying what it is they are trying to achieve?

- WINNING

This is a big one. Without goals, how can we ever know that we've WON? Life is hard enough without being able to celebrate the small wins along the way. Most of us feel deeply within us the need to achieve and the need to progress, and without setting goals, we can never really know how to get there or when we've arrived.

So how does all this relate to your money?

If you don't intentionally make time to set yourself some money goals, you may just find you end up in one of two camps:

I never have any money to do anything I want. Everyone around me is doing incredibly and going on lush holidays and driving Ferrari's and eating oysters and I just don't get it...

This is a classic example of 'I don't know what I really want, so I'm going to compare myself to everyone around me even though everything they're doing doesn't really interest me very much'. STOP. NO. It doesn't need to be like this. You JUST need some goals...

Oof, no, sorry mate, I can't come for a pint tonight as I'm on a budget, I'm going to be a millionaire you see so I can't really spend unnecessary dough on anything I don't absolutely essentially need for my basic survival needs. Only 17 more years of this and I'll hit that magic number!

This one is potentially even worse, and if you're in this camp you need some goals ASAP. As Pete Matthew from Meaningful Money says (fantastic bloke by the way and definitely check out the Meaningful Money podcast):

Money is not an end in itself.

The pursuit of financial freedom needs to be for something. You don't make sacrifices and work hard to build up a big pile of wealth, just for the purpose of having a big pile of wealth. That's not financial freedom, that's hoarding, and it won't bring you happiness (unless you are Smaug from The Hobbit, in which case I have no idea why you're still reading, you big scaly beast). That money needs to HAVE A PURPOSE.

Let's see how we can avoid having to ever end up in either of these two situations.

MONEY GOALS

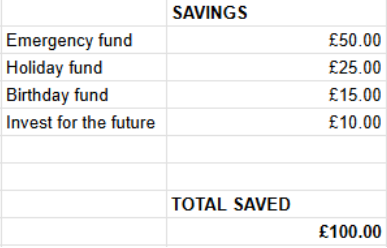

You may remember my incredibly detailed and beautifully designed speed budget.

In that budget, I included a column for savings that went between my essential expenses and variable expenses (practicing paying myself first).

While it may not look like much, these are in fact some very basic but great starting savings goals, and I'm going to explain them in a bit more detail to help you get started setting your own goals and implementing them into your budget too. But before that, realise this: setting financial goals IS A SUPERPOWER. If you can set effective goals that are attached to a savings amount, you will PREVENT yourself from EVER SPENDING MORE THAN YOU EARN and ensure you are always moving forward.

Let's start with the holiday fund, as I'm going to go into emergency funds (and why you need one YESTERDAY) another day. PLEASE remember these are made up numbers and I fully appreciate that holidays are far more expensive than I'm about to say they are.

So how do we actually set ourselves a goal?

The Goal:

I want to go on a weekend away, once a year, that will cost me £300.

Breaking down the goal:

Once a year = every 12 months. So, let's take our money goal and work backwards.

£300 / 12 = £25

Therefore...

Savings goal:

I will save £25 a month, so that in 12 months, I will have saved £300 to pay for my weekend away!

And just like that, we've set ourselves a specific, measurable and highly achievable goal.

As obvious as this may seem, implementing this goal setting process is a financially freeing, debt-avoiding superpower. Why? Because when it's time to go on your holiday/pay for insert other financial goal, guess what? YOU'VE ALREADY PAID FOR IT.

This isn't just an incredibly powerful mindset shift: if you can implement financial goal setting effectively, it will completely change the way you view everything about your own money and time, as well as keep you well away from spending more than you earn.

Let's say you are paid £15 an hour and you have set yourself a realistic and exciting goal that will cost you £60 in 4 weeks. Suddenly, instead of having to pull £60 out of your backside at the end of the month when you've already spent everything, you can think to yourself throughout the month:

If I put £15 a week safely away instead of spending it, which is just an hour of my time, I'll have already paid for this by the time I need it!

This doesn't just work with short-term goals either: there are countless short, medium and long-term financial goals you may went to set to keep yourself MOTIVATED and WINNING! Some examples?

- Home ownership

- Having children

- Buying a new car/bike/skateboard

- Taking your partner on a fancy date night once a month

- Starting a new business

All of these goals are achievable. Remember, all you need to do is work out:

- How much they will cost you

- When you want to achieve them

- Work backwards to give yourself the magic savings number

- Stick that magic number in your budget and get to work!

I hope that was helpful, and you feel a bit more confident to set yourself some badass financial goals. Remember that part of setting goals is to celebrate the wins, so be kind to yourself, and remember that this is YOUR MONEY, and therefore YOUR GOALS.

If you can get this nailed, you'll forget the last time you thought:

Damn, I've got 'X' coming up and I don't know how I'll afford it!

What goals are you going to set for yourself for the coming month?

Cheers!