Emergency Fund 101: I've lost my job, and here's why it doesn't matter

"Save for a rainy day"

I really can't remember the first time I heard this saying. It's one of those quotes that's just ingrained in every fibre of your being without you ever really knowing why, like a strange but wise conspiracy that we've all somehow subconsciously absorbed.

I suppose the premise is fairly straight forward: put some pennies away for when you need them. This makes perfect logical sense, and aligns with the survivalist behaviour of saving and investing as well as making up an absolutely essential part of our budget. Not only that, but we now know how and understand why we need to set realistic financial goals and how to save for them.

But... Where exactly does the rainy day come in? Even high street banks have adopted the term with references to easy access savings accounts as 'rainy day' funds.

Upon a bit of further digging, it appears others have had the same question. This post queries why we aren't saving for 'an unexpected storm' rather than a rainy day, as this presumably depicts a scenario far worse. It's not like the presence of rain immediately suggests poverty and strife: on the contrary, rainy days are quite important for, well, everything. Unless we start growing our own food in labs and can work those labs without dying of thirst.

While it's clear that the concept of putting away a portion of your income to use later dates back a long, long, long way - The parables in 'The Richest Man in Babylon' supposedly originate some 4000 years ago, and even the the Bible makes reference to saving by 'gaining wealth little by little...' - the real danger behind the rainy day seems elusive in nature.

It may be that what we need to take from the phrase is that no two rainy days are the same. While it's true that farmers are grateful for the rain and fear a drought, the thought does little for me on a Monday morning with a 10 mile bike commute ahead of me when the sky seems to be falling down.

Bringing it back to money, much like the rest of personal finance these things are entirely individual and personal to you. My goals are different to yours, as is my income and my expenses.

There are however some things that a lot of us sadly do have in common in the current economic climate. Statistics taken from the Bank of England show that in 2024:

Up to a third of adults (34% ) have either no savings or less than £1000 in a savings account

Almost two-thirds of people believe they wouldn't be able to last three months without borrowing money

Considering the average monthly household spending in the UK is over £1600 just for essential housing costs, these statistics are a bit scary. No matter what your magic 'what's left' number is at the end of your budget, if you have less money saved than you have going out each month, then by definition you are less than one payday away from being able to afford to live.

Scary right?

WRONG!

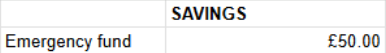

Because we're going to fix it right now, together. As per the title of this post, I've recently lost my part-time job that was supporting me through my postgraduate studies. You saw, however, that one of the savings categories (THE FIRST ONE!) on my hypothetical super simple basic budget was £50 a month for an emergency fund.

Let's pretend for one perfect and dreamy second that my rent cost £600. Let's also pretend that I am really unlucky and find myself jobless once every year, and it takes me a month to get a new job each time I lose one. Now, all other areas being somehow covered, for that one month I know I can cover my rent (the roof over my head) WITHOUT having to borrow/beg/steal.

Because I'm gratefully not that unlucky, I don't find myself consistently without work. Slightly less gratefully, however, my rent DOES NOT cost £600. This combination means that, despite it taking a really bloody long time, I managed to get to the point where despite finding myself suddenly without work, I'm covered. Sorted. Cosy, almost (not really).

My 'rainy' day came, and I made sure I had an umbrella. Not only do I not have to resort to debt, or even resort to rice cakes on toast for a month, the psychological feeling of knowing you have enough to cover you is truly powerful.

(Just to caveat, this, much like basically everything I write about, is based on the premise that you actually have some margin for savings. If you don't, then you will need to either spend less/earn more (more on that soon), or seek help).

Having said all that, I suppose the ultimate question is:

What does a rainy day look like to you?

How to build your emergency fund

Let's get practical so that whatever your rainy day looks like, whether that be losing your job, your boiler going pop mid-winter or your car needing emergency surgery, you're covered and the situation goes from being an emergency, to being an inconvenience.

The most important thing to remember: this money is for emergencies. That's it. It sits there to protect you from disaster should it come. So be disciplined, and leave it be!

A quick note on amounts.

Some fairly conservative financial guru's suggest up to six months of expenses saved for emergencies. Personally, barring serious horrific injury/illness and lifechanging disability, I don't see myself being unemployed for six months, so I stick to around three months. This is mostly down to your own personal risk tolerance, but start with one months worth of expenses and then you can always save later down the line (with slightly less urgency, now you've given yourself a months buffer!).

Work out your emergency number

Your emergency number is:

Your total essential monthly spending X how many months savings you want.

Part of this step is accepting that in an emergency situation, discretionary spending stops. This makes it a bit easy to work out our emergency number.

Total essential spending includes rent/mortgage, bills, food (groceries, not takeaway or Michelin star restaurants), minimum payments on any debt, and that's about it. Keep it simple and you'll have an easier time keeping track. We all seem to like round numbers, so I usually round up to the nearest grand.

Let's say all of those expenses add up to £1600 and I want my three months of buffer.

£1600 x 3 = £4800

My emergency number = £4800

Reflect it in the budget

If you're currently below your emergency number, you need to start working towards it.

How do you do that?

Work backwards and stick it in the budget! Set yourself the goal of having 'X' amount in your emergency fund in 'Y' amount of time. This might look something like:

I want to save £100 a month into my emergency fund so at the end of the year I have a £1200 buffer. This will cover a month of rent, bills and my groceries. No, I probably won't be able to go to the pub that month but I won't be homeless if my income suddenly stops.

SAVE IT, and remember that no matter how hard a week you've had, Friday night takeaway pizza is NOT AN EMERGENCY

All that's left is to work out where to put your hard saved emergency cash.

I'll point you to the place I've been going ever since I started saving and getting savvy with my coin - Martin Lewis lays it out far better than I can.

The reason you want to choose one of these top savings accounts is so that your money is earning interest whilst it's sitting there. In my truly honest opinion, however, this doesn't really matter with your emergency fund - the purpose of the fund IS to have an easy (and instant) to access pot of money to use as soon as you need it. The purpose IS NOT make money on it. For full transparency, I do however use a savings account that pays interest, because I like to think of every penny as working as hard as it can for me.

And that's really all there is to it.

If you follow the above steps, you'll be on track to sleep easier at night and have put a massive, powerful wedge between you and disaster. It feels damn good to have that extra arrow in your Budgetopian quiver, and now we've protected ourself from chaos, we can really start moving forward...

Get to it and good luck!