The Million £ Chicken Burger: How to invest for beginner Budgetopians

Every day, when I check in to see if I have a million people on my mailing list yet, I have a quick glance at my list of published posts. Aside from inwardly cringing at how productive I'm not, I've decided I'm much better at writing titles than I am at writing posts... and in the process discovered that I'm far too self-critical.

It's my party and I'll blog when I want to!

Something that really is almost unforgivable, however, is that we haven't yet spoken properly about something we REALLY need to speak about, especially as I've teased and promised a lifetime of riches and gluttony if you simply check in with what I want to share with you.

INVESTING

We've spoken a bit about the mechanics of investing: hopefully you remember my highly lucrative apple business, but if you don't, have a read of that post first to hopefully disparage any ideas that investing is something to leave up to the experts, something that is far beyond you or something that too closely mirrors gambling for your comfort.

It might be that your current idea around investing resemble some of the following:

- A white-knuckled grip on the edge of your desk with sweat pouring down your face as you pore over charts of live price movement

- That bloke that occasionally, for no discernible reason, pops up on your Insta reels every now and then in a McDonalds drive-thru showing you his insane profits from his work-from-home day trading job.

- Trying to work out what individual stocks are worth buying, and then painstakingly tracking their movements over the course of years and decorating your bathroom with piles of printed quarterly reports to work out profitability during your morning ablutions

I'll sort you out on all of these concerns in time: the truth is, none of them need be you (and definitely aren't me!).

All sorts of clever people have spoken on the subject of investing throughout the years. I could bore you with numerous quotes on the merits of investing for the every day person, but the reality it, that wouldn't make me look any more like I know what I'm doing than laying out the plain and simple truth:

Keeping your money in savings accounts, or worst of all, 0% interest current accounts, renders the value of your money less as each and every year passes thanks to the effects of inflation (The Enemy).

On the other hand, investing, which as we've previously discussed involves buying things we are hopeful (based on evidence) will go up in value, protects our money from the effects of The Enemy by (hopefully) using it to buy things that will go up in value over the long term.

With inflation currently sitting around 2.5%

- In a 0% interest current account, £100 of your hard earned cash will be worth approximately £97.50 next year

- In a 5% interest savings account (which up until recently would have been more like 0.1%), that £100 will be worth £102.50

- In a globally diversified fund of equities historically returning a post-inflation 7%, that £100 will be worth £107

The Eighth Wonder: The magic of compound interest

"The Compound Effect is the principle of reaping huge rewards from a series of small, smart choices"

Not feeling super excited at the prospect of an extra 7 quid after all that faff of bothering to invest?

I completely get you, and I remember feeling the exact same way. What changed things was when I realised the secret weapon that makes that 7 quid worth so, so much more: time.

Remember once more, if you'll indulge me, my chicken burger.

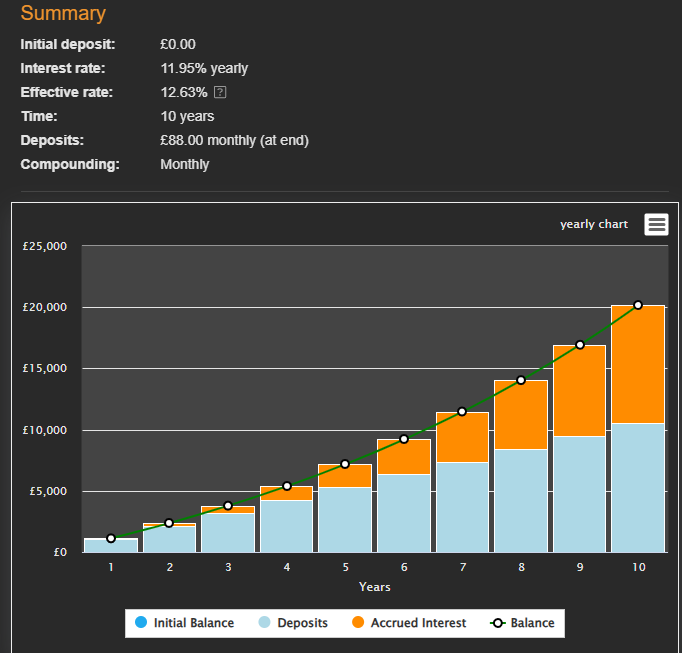

I showed you with a graph how a series of small purchases, if that same money was invested instead, can result in a huge sum over the span of 10 years.

Before anybody pulls me up on the interest rate used in this calculation, that is the average return of a globally diversified fund over the time period specified, so whilst high is in no way an impossible return.

But how on earth did £88 a month on chicken burgers get to £20,000 in 10 years?

Compounding

As per Investopedia's definition, compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid.

Put simply, this means that you don't just gain on the original amount invested or saved: you gain on the original amount plus any gain already added.

Let's use a stock market average of 7% annual return and do some maths, pretending you want to invest £1000 a year.

Year 1 - £1000

Year 2 - £2066 (7% on £1000)

Year 3 - £3206.62 (7% on £2066)

Year 4 - £4427.08 (7% on £3206.62)

Getting the picture?

By year 10 you have £15,728.33 - and only put in £10,960

Let's go back to the above graph - and carry on until (early) retirement for another example of how powerful the effect of compounding really is.

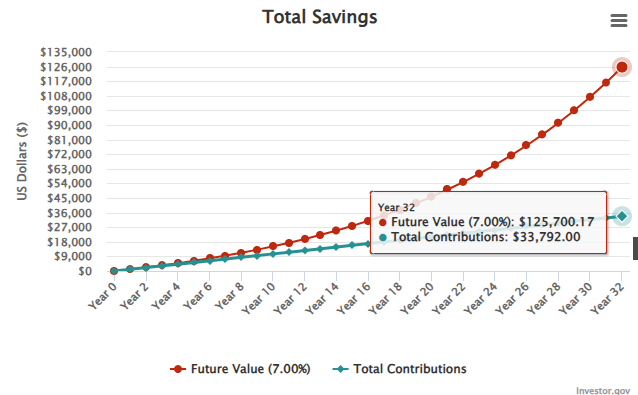

If I carried on saving my £88 worth of chicken burgers every month until the age of 50, at an average return of 7%, compounded monthly:

I would have a pot worth over £120,000, whilst having only contributed £33,792. Now imagine what the numbers would be like if I actually intentionally put money away for this purpose, rather than just the 'pocket change' I'd otherwise be wasting on fast food that I probably shouldn't be eating anyway.

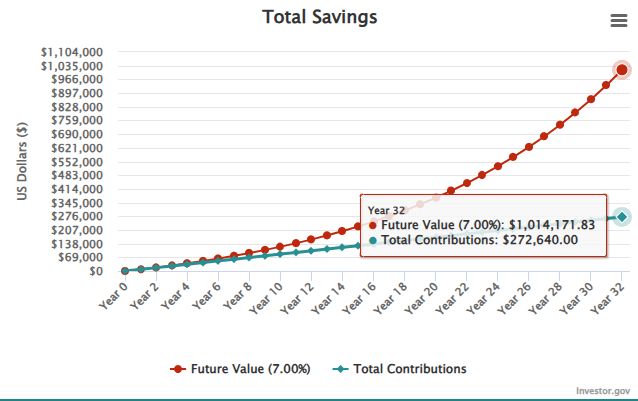

I know what you're thinking - how much chicken would I need to not buy in order to retire a millionaire?

Fear not, I knew the question was coming!

If you didn't buy £710 worth of chicken, per month, from the age of 18 to the age of 50, you would have on your 50th birthday:

Just a couple of zingers over £1,000,000. Not bad, right?

And chances are, you aren't going to spring out of bed on the day you see that number and immediately spend all of it - in fact, given the habits you'll have mastered to get there in the first place you probably won't do much of anything at all, leaving it there to continue happily compounding while you grow grey but happy, continuing to pop your £710 away every month.

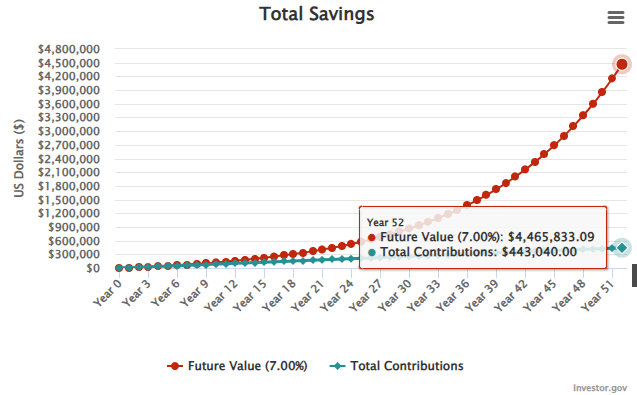

So in another 20 years?

Hopefully, my point is well and truly made.

Active vs Passive

Now you understand why you absolutely should (and probably need to be) investing, you need to know in what, and how.

This is where we go back to our idea of investing as a terrifyingly complicated feat that only the most intelligent and wealthy of individuals should ever even contemplate.

What you're probably thinking of is active investing.

Active investing is pretty much what it says on the tin - you actively buy and sell individual stocks, your companies such as Tesla, Alphabet, and Meta, at a price you see as reasonable and then sell when those companies do well enough in your valuation to be worth selling.

There are numerous problems with this method of investing, the most important being this - when you first poked somebody on Facebook, did you imagine the company that allowed you to do so might one day be worth £62 billion?

Probably not. You'd tried numerous other platforms before, they fizzed out of popularity and eventually into obscurity.

Thousands of companies are listed on the stock market - and thousands fail to be profitable, and eventually just sort of, well, die.

Guess what happens to the money you invested in a company that dies? It dies too.

Unless you can be absolutely sure that you're betting on the next Meta, investing any reasonable sum in individual companies will lead to sleepless nights and raw nails as you chew away your hopes of a future of abundance for the much less realistic hope of a random super-company.

The truth is, professional investors are paid hundreds of thousands a year to invest in individual companies, the researching and choosing of which being their actual full time job, and still don't on average outperform investors who just don't bother with any of that.

So what DO you bother with?

The Passive Solution

Imagine I gave you a magic basket, and told you that in that basket I would put every great invention and technological advancement of the next 50 years in it. Some of these will undoubtedly fail, sure - but the basket will ultimately hold the winners. Oh, also, no need for you to invest in the companies behind these inventions and advancements, instead, just buy a slice of my basket and capture everything inside.

What I'm describing is the premise behind passive investing, usually in the form of index funds or ETF's (exchange traded funds) - don't worry, these are just what the products that capture the broad market are called.

Instead of actively picking and choosing individual stocks you think might perform well, and probably fail alongside spending far too much of your life energy worrying about the result, you can simply buy a slice of a fund that already holds every great company inside of it.

Yes, the returns will be lower than if you happened to gamble upon the next Meta or Tesla, because they will catch the companies that don't do so well - but what makes up for this is the certainty that you will capture the companies that do incredibly well, without the need of a crystal ball, incredible luck or otherworldly valuation skills.

What you also get is diversification, a pillar of good investing practice. The time old adage of not putting all your eggs in one basket applies here: why put all your money into a single company, in a single sector, based in a single economy, when you could instead spread your money across hundreds of companies, sectors and economies across the globe?

For the vast majority of individuals, the Budgetopian way of choosing the easy life and passively investing your way to financial freedom is probably the way to go - then you can sleep as soundly as this little guy:

Where do I sign up?

Getting started is super easy - you just need to choose a platform, which is essentially just a financial institution that 'holds' the funds you might want to invest in. You want to do a bit of research here - look for low fees and happy customers. All of the big platforms in the UK are covered by the FSCS - the financial services compensation scheme, meaning you really, truly don't need to be worried about anyone running off with your money, provided you do your due diligence in picking a platform and don't respond to texts from rich estranged cousins.

On your platform you can choose funds that hold companies in different countries, such as the FTSE in the UK or the S&P in the USA, or simply choose a fund that holds companies from all around the world. These are usually called 'All-world' or 'Global' funds. This isn't a recommendation and I have no link to the company, but I personally use Trading 212, which is a platform that also has a quality mobile app and low fees, and just stick everything in a fund that covers the entire world.

Then, all that's left to do is work out how much you want to invest - AFTER you've sorted out your priorities and got a strong budget to hand - and go to town.

The Budgetopian method of investing is exactly this - who doesn't like more eggs and more baskets after all?

Budgetopia, here we COME!

Now get out there and let the compounding begin - what are you waiting for?!

Any questions, as always, comment below or email me at budgetopian@gmail.com