Budgeting 101: From Zero to Legend

A budget is telling your money where to go instead of wondering where it went.

I love this quote by Dave Ramsey. It truly encapsulates everything we get wrong when we start questioning why we don't seem to be moving forward financially, and mirrors what I meant when I spoke about paying other people's bills rather than yourself.

If you've found yourself wondering where your money went at the end of the month, every month, I've got your back and I promise we can fix it.

To start with: what do we actually even mean when we use the word budget? It gets thrown around (I'm throwing it around) like everyone knows what they're talking about but I'm not sure I've ever actually seen it defined.

Good old Oxford Dictionary reckons:

an estimate of income and expenditure for a set period of time

Chef's kiss

The only thing I would say about this definition is that I think we can do better than an estimate, because an estimate implies that we're going to make a rough guess and then try and stick with it. That's all well and good and a good starting point, but IT'S SIMPLE ENOUGH THAT WE CAN DO BETTER.

And we're going to do it together. Ready?

LET'S GO!

Some key things to consider before you whip out the spreadsheet/notebook/chalkboard/clay tablet.

- DEBT

One of the most essential parts of any budget is PRIORITISING where you're going to send your £ soldiers to fight for you. If you're in credit card debt, or struggling to pay off a car finance, this absolutely completely essentially must be a priority that gets reflected in your budget. DO NOT set up a beautiful plan for your spending that revolves around solely making minimum payments: you'll be budgeting yourself into a NIGHTMARE. We will cover debt another time, but for the purposes of this guide, assume you'll be throwing as much as is humanly (and with your sanity in mind) possible at your debt.

- KNOW THYSELF

If you budget £50 for yourself to spend on eating out next month when for the past four years you've worked your way methodically and determinedly through every chicken shop in your local area and beyond (ask me how I know) you are setting yourself up for nothing but disappointment. Be realistic with your wants, and remember we're doing this to help us find HAPPINESS and FREEDOM, not misery. This leads nicely into the next consideration...

- HONESTY

If you're going to spend it, it goes in the budget. I don't care what it is. This is a judgement free zone. Whether you get your hair cut every 2 hours, overspend on vintage porn or have an addiction to buying Fortnite currency, put it in the budget. The more honest you are with yourself, the stronger your budget will be.

Now those are out of the way, we can move on to the really exciting bit...

THE SUPER SIMPLE BUDGET FOR BEGINNERS

There are A LOT of different budgeting methods floating about. In fact, I'm convinced the reason there are so many is because people procrastinate from actually doing a budget, and instead spend all their time thinking of new and exciting methods.

For today, we're just going to focus on the simplest form of a budget as a way to get started. Money in, and money out.

Open up your spreadsheet app/notebook/chalkboard/clay tablet (I don't want to overdo this joke so from now on I'll just say spreadsheet), and I want you to list, in beautiful, satisfying boxes of goodness, your in's, your out's, and what's left.

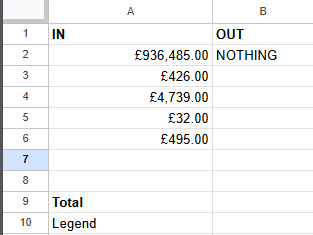

I'm going to do it with you right now (with random but believable numbers) and see how long it takes me. The result...

4 minutes. I'm actually a bit disappointed in that to be honest, but I'll try and do better next time. You've also now had a glimpse at my design skills, but hey, I was in a rush.

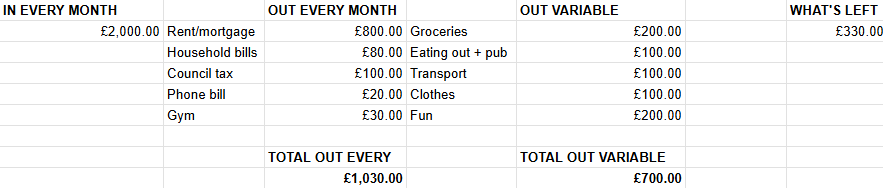

You can see I've listed my salary, as well as the expenses that come out every month. These are also known as fixed costs. I've then listed the expenses that change every month, and been fairly liberal with my hypothetical spending in my opinion (£200 on groceries as a single person would be INSANITY that we would need to fix IMMEDIATELY!).

Having done all of that, we're left with a magic number...

£330

This was so beautiful I felt it deserved some space. 330 badass and hardworking soldiers to either send off to fight for you or park somewhere safe to keep watch for an imminent battle (opinions on that weird and arguably violent metaphor for saving?). Obviously the above budget is extremely basic, rough, and missing a universe of individuality and nuance, but hopefully you get the general idea.

BUT WAIT!

You say, looking rather smug and at the same time disappointed...

What happened to paying other people first? What about saving for the future?!

I wondered when you'd notice... and I am so damn proud of you.

Of course, what my super simple basic beginner's budget does disastrously wrong is sets me up for a month of ONLY PAYING OTHER PEOPLE. How disappointing is that?!

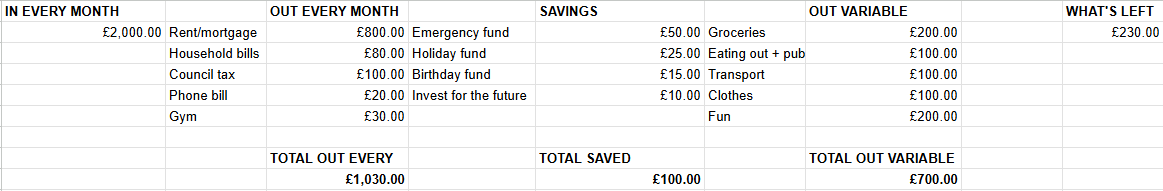

Let's see if we can fix it...

There we go. Much better. And I've even worked out that I still have £230 left after all of that to send off somewhere else, whether that be a different savings goal (probably a good idea!) or that new metal detector you saw on Ebay for your trip to the coast (no idea why I went for that but let's run with it).

What you've ultimately achieved here is this - you've told your money where to go. At the end of the month, you won't be wondering where your money went, because you had already told it where to go.

This is actually really useful. Wow, you're so incredibly wise and helpful. I can't wait to be on my way to Budgetopia with all the other legends, wizards and hero's!

The only slight problem is, my 'what's left' category comes out at a big, fat:

0

While this may be true, and for a lot of people, especially these days, it's an unfortunate reality, that doesn't mean we can't do anything about it. Remember when we spoke about how to get started? First things first, we take stock. With the bones of a budget done, we've achieved that.

Congratulations, amazing, seriously, give yourself a slap on the back because it can feel like a pain to even get that far.

But to properly take control and turn that 0 into serious digits, there's a few other steps we need to take to get on the path. And that is exactly what we are going to do together.

If you've followed along with this then, well, damn, well done and thank you so much, but if not then seriously take some time to sit down with a cup of coffee (or tea, or wine) and take a good, long look at everything going out of your account. This is a big topic, and one we'll revisit on numerous occasions, but for now, if you can just do that to get a general overview of where the money is going, you're off to a fantastic start.

You've got this.

Until next time!